The 2024 Future of the Creator Economy Report is out now!

Dig into creator economy trends in earnings, monetization, music, and AI.

Today, Epidemic Sound, the soundtracking platform for content creation, released the 2024 Future of the Creator Economy Report, delivering key insights into the dynamic realm of content creation, the challenges and opportunities creators face, and their predictions for the future.

The company’s second-annual report specifically explores emerging trends in content monetization, identifies top earning platforms, and examines the integration of AI and music in content creation. The report is based on a survey of 1,500 content creators who are currently monetizing their work.

See the full methodology here.

Epidemic Sound’s 2024 Future of the Creator Economy Report shows that as the creator economy grows, creators are becoming more experienced in identifying new monetization and growth strategies, increasing focus on personal branding and learning how to best incorporate music and new technologies into their content.

Career opportunities within content creation strengthening

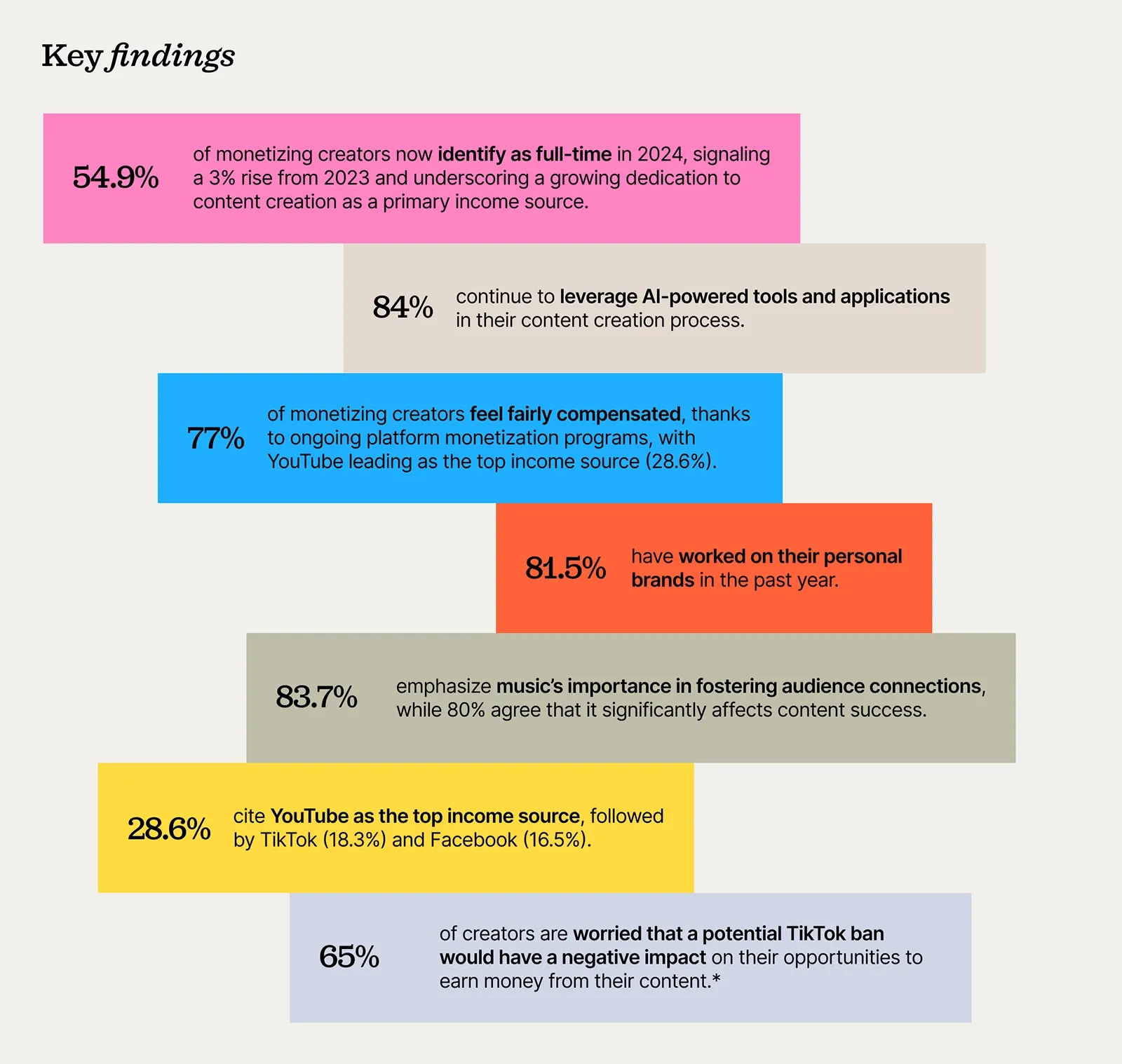

The digital content creation landscape continues to thrive, with 54.9% of creators now identifying as full-time in 2024, marking a 3% increase from 2023. This highlights a growing commitment to content creation as a primary income source:

- 49% of monetizing creators spend 20 hours or more per week on content creation, emphasizing the commitment needed for engaging content and audience engagement.

- 38.9% of monetizing creators have been producing content for 2-5 years.

- The majority of creators (74.7%) choose to create video content, while the other most popular content formats include visual (51.1%), written (47.7%), and audio (42%).

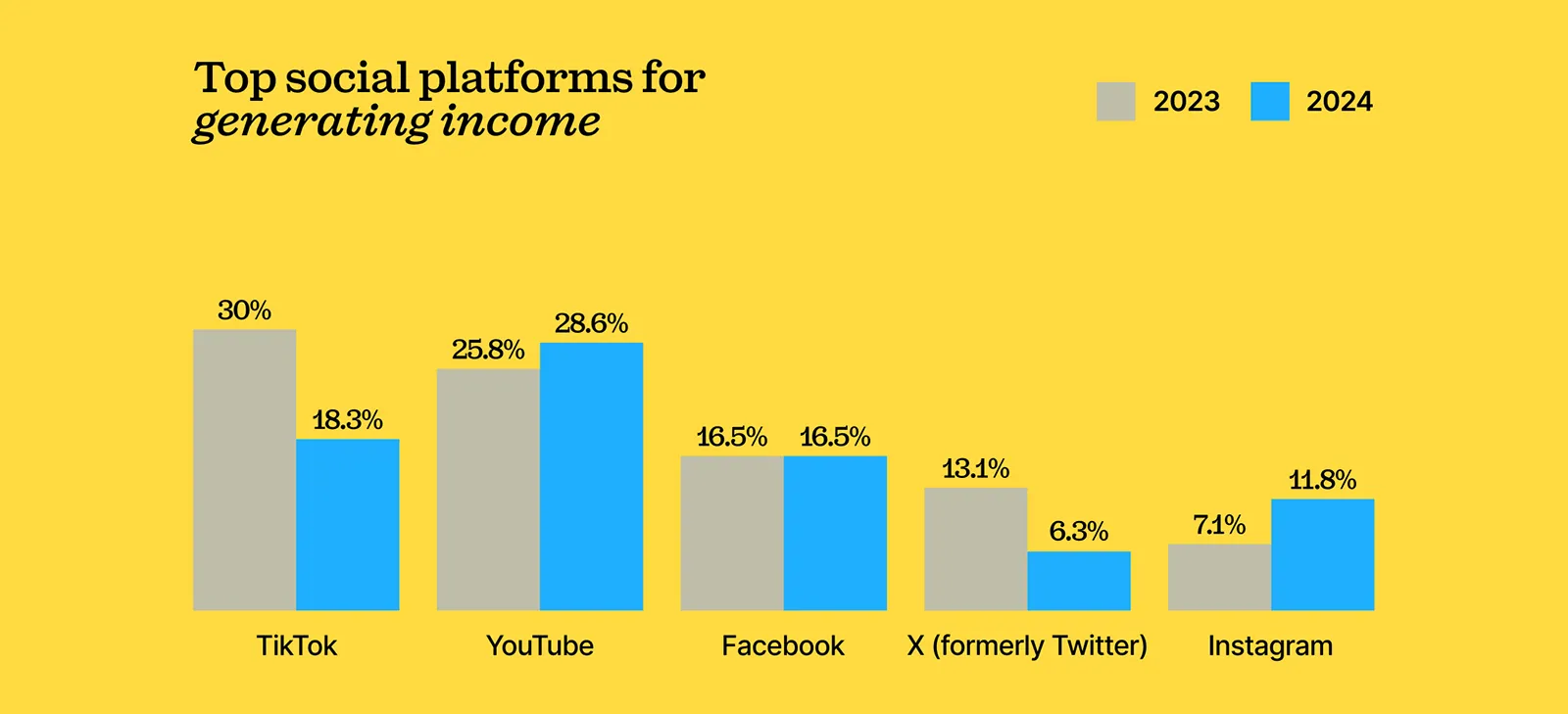

In 2024, content creators continue to distribute their work across multiple platforms to ensure income stability. YouTube (28.6%) reclaimed the top spot from TikTok (18.3%) as the platform where creators earn the most income, while Facebook (16.5%) followed closely behind. Snapchat is the least profitable platform for creators (2.5%), despite its recent initiatives to attract more users.

When it comes to monetization methods, live streaming, ad-revenue share programs, and paid subscriptions are the most popular options. Brand sponsorships saw a notable 14% decrease compared to the previous year, highlighting the delicate balance creators navigate between their personal beliefs and maintaining creative independence.

The majority of creators are optimistic about monetization, despite challenges

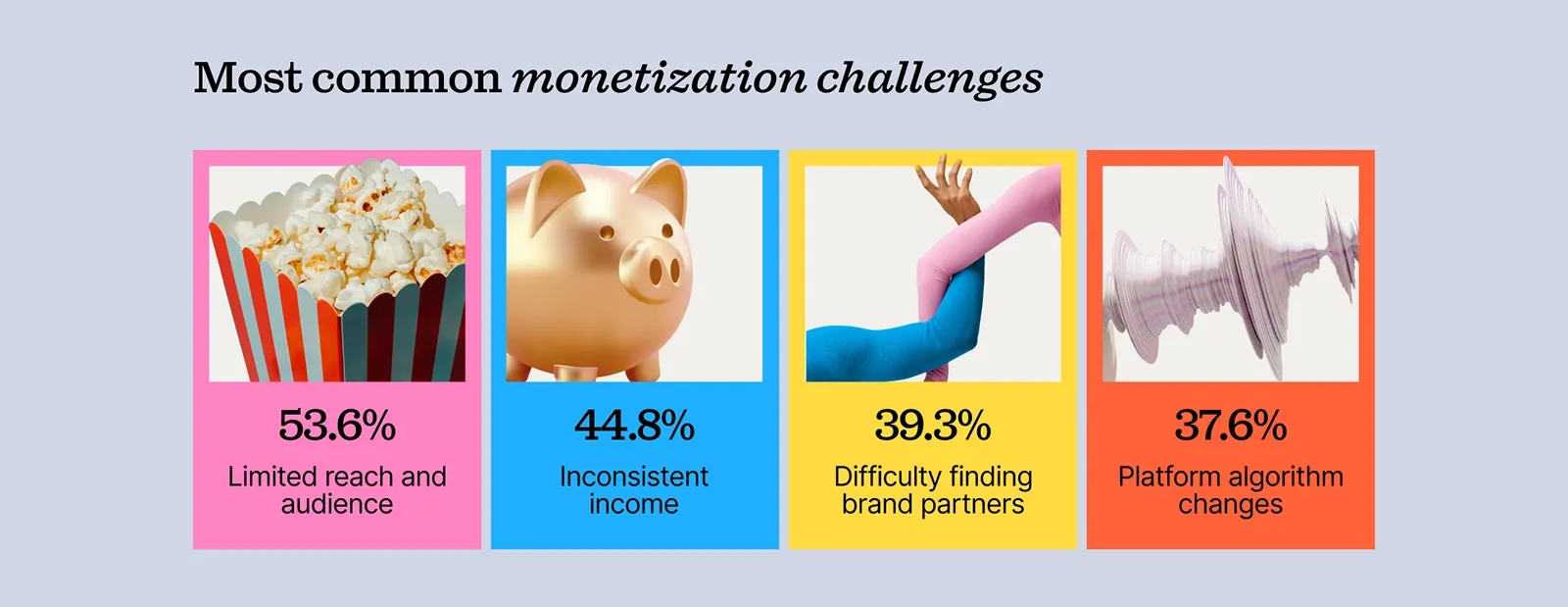

Despite these adaptable strategies, 58.3% of creators say they have recently faced challenges when monetizing their content. However, this represents a marginal improvement from the 61.5% reported in 2023. These persistent hurdles emphasize the complexities of optimizing content for revenue generation in the digital environment.

Creators remain optimistic about income growth, with 73.1% anticipating improvements in 2024 due to expanding monetization options and strategic content diversification across platforms — an increase from the 71% reported in 2023.

The majority of content creators feel adequately compensated, place emphasis on personal branding

77% of monetizing creators feel fairly compensated, thanks to ongoing platform monetization programs.

However, challenges persist as 62.3% of creators face difficulties aligning content production with monetization strategies, emphasizing the ongoing struggle to maintain creative integrity while optimizing for financial success. As a result, personal branding has become crucial for creators.

A majority of creators, 81.5%, have actively worked on their personal brands in the past year, and 38.3% regard personal branding as extremely crucial.

Moreover, 80.9% of creators have invested in digital marketing analytics and other business-related skills to bolster their content creation careers in the past year, and 27.5% have taken on additional roles within their businesses to accommodate changing industry demands.

This flexibility reflects the dynamic nature of content creation work and the importance of continuous skill development.

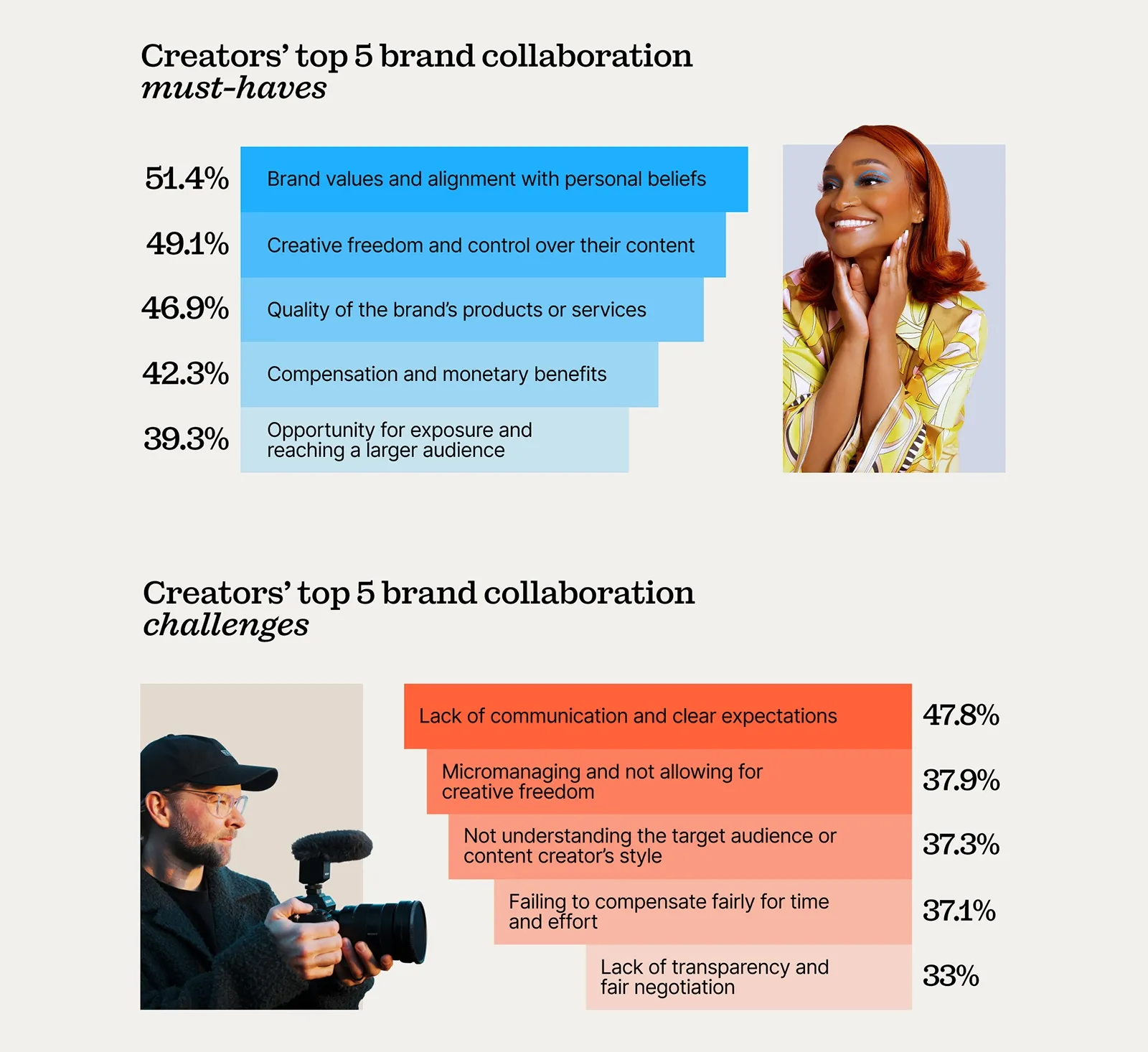

Challenges and opportunities in brand collaborations

Collaborating with brands remains a balancing act for creators who seek alignment with personal beliefs (51.4%) and creative freedom (49.1%). Common challenges in such partnerships include lack of communication (47.9%) and restrictive creative control (37.9%).

Creators recognize the potential for successful collaborations within the technology (17.7%) and entertainment (16.9%) sectors. While brands’ understanding of content platforms is generally rated ‘Good’ (36.7%) to ‘Excellent’ (37.9%), there is still room to maximize platform capabilities and facilitate stronger partnerships.

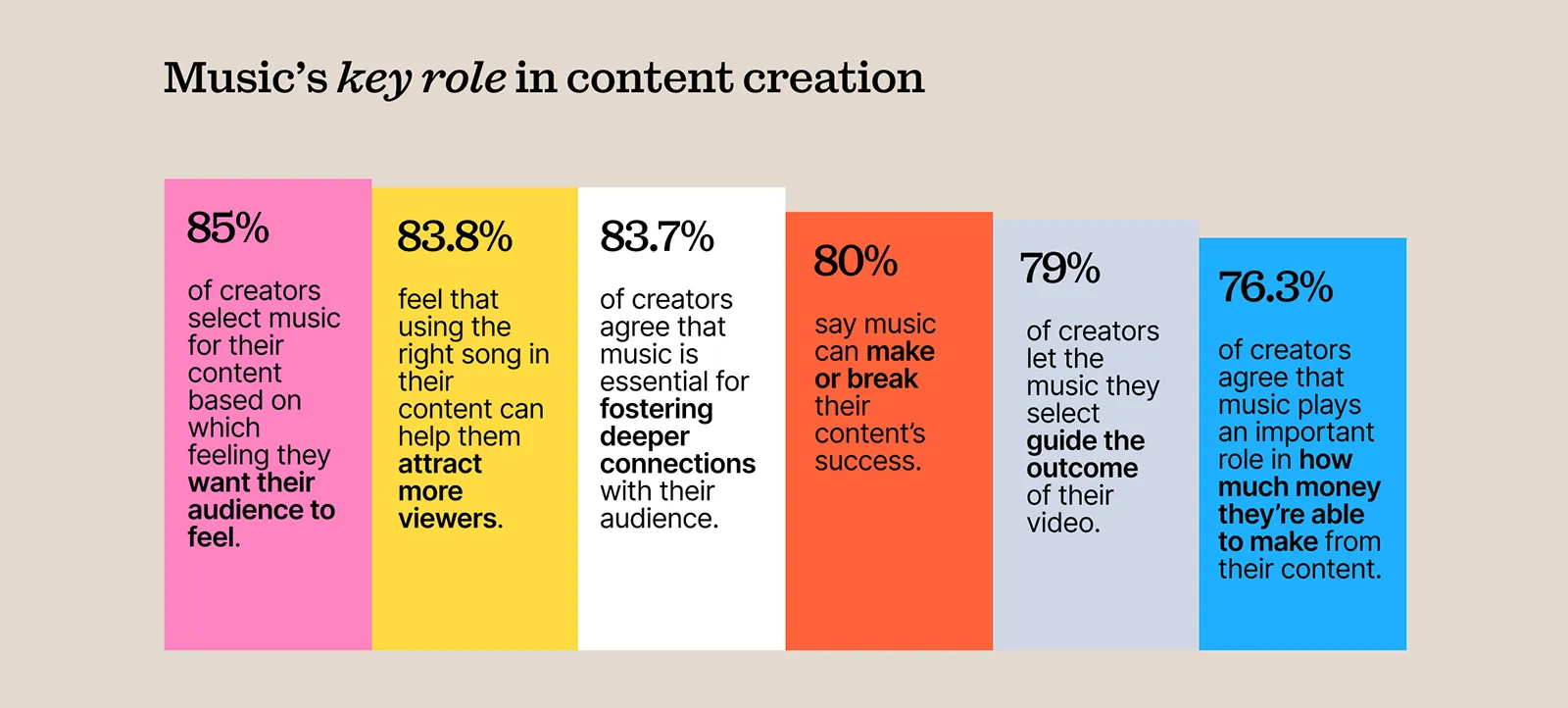

Music’s influence on engagement, monetization, and relevance

Content creators overwhelmingly acknowledge the pivotal role of music in producing engaging and impactful content.

This emphasizes the importance of carefully curating music that resonates with the content’s theme and aligns with monetization goals and audience preferences.

Additionally, 81.2% of respondents acknowledge that music plays an important role in keeping their content relevant to pop culture trends.

However, integrating music into content is not without challenges. A substantial 50.7% of creators have encountered content removal, muting, or demonetization due to copyright issues, underscoring the complexities of music copyright.

AI tools in content creation: Amplifying creativity and efficiency

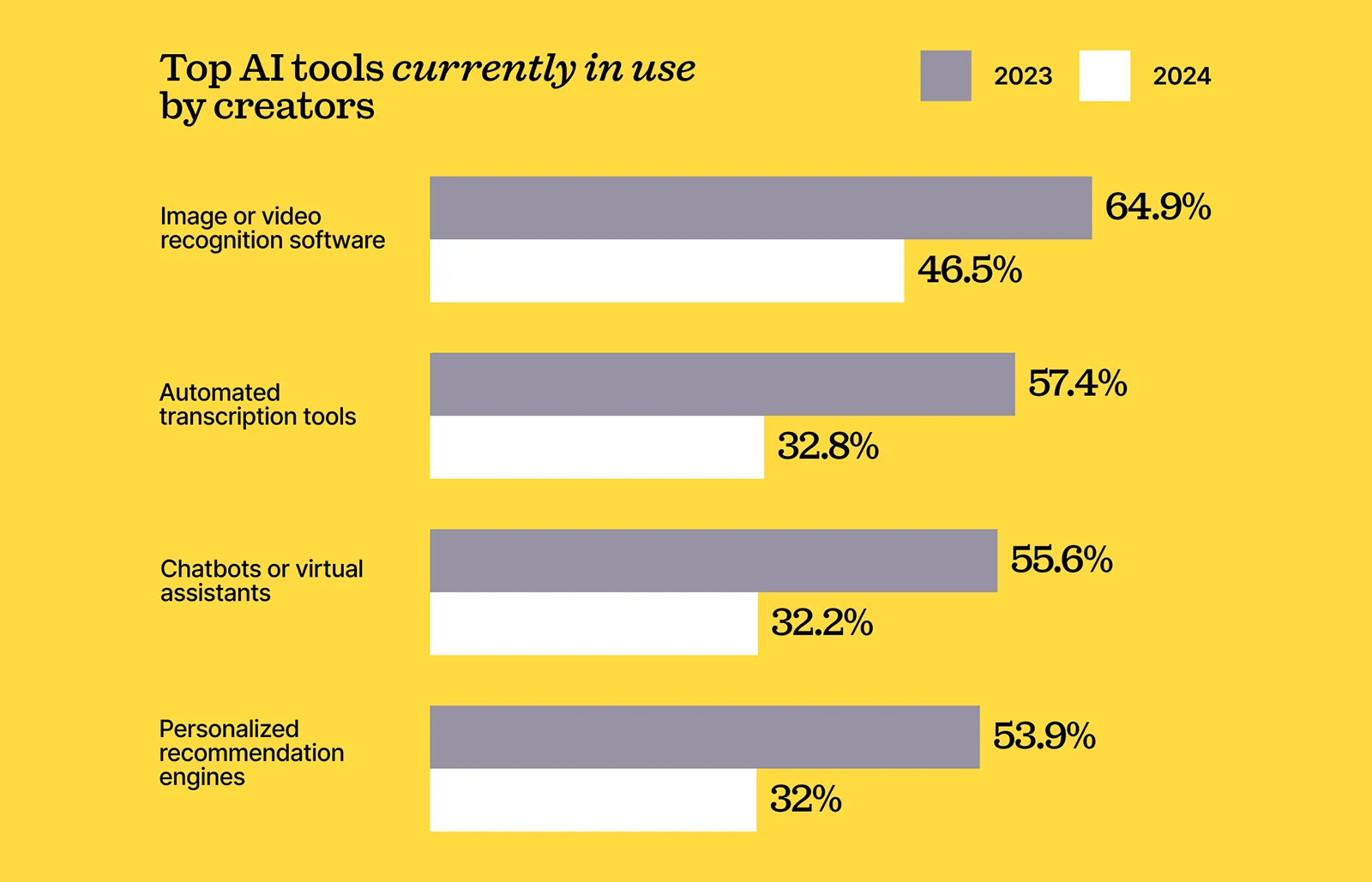

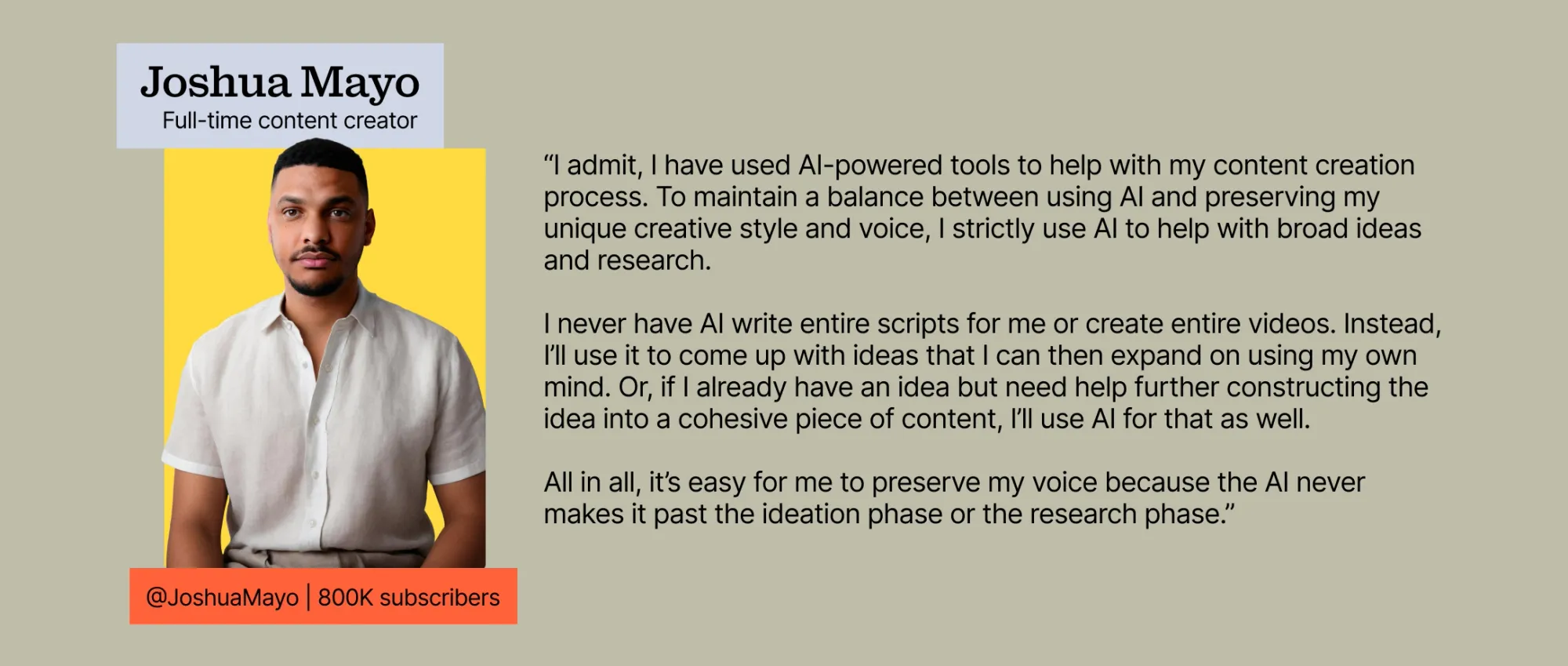

A substantial 84% of content creators are leveraging AI-powered tools and applications in their content creation process, highlighting the sustained impact of AI within the industry. However, while overall AI solution adoption remains strong, certain tools have witnessed a decline in usage during 2024.

Creators appreciate these tools for boosting productivity (50.1%), saving time (53.7%), and reducing costs (42.5%).

Despite the numerous benefits, concerns surrounding the use of AI in content creation remain. Quality of AI-generated content is a concern for 48.9%, lack of originality worries 38.5%, and plagiarism apprehensions affect 33% of creators.

Furthermore, 28.7% express reservations about the ethical implications of AI usage in content creation, emphasizing the importance of balancing human creativity and AI capabilities to maintain authenticity and originality.

Creators’ Perspectives on the Potential TikTok Ban

In light of recent discussions surrounding a potential TikTok ban in the U.S., we conducted an additional survey of 1,000 monetizing creators to gather their views on how this might impact their work within the creator economy. This section presents the perspectives of these creators, providing valuable insights into how they are adapting their strategies and approaching the possibility of a TikTok ban.*

For creators who rely heavily on TikTok, concerns are mounting over how a potential ban could impact their content monetization opportunities. TikTok plays a critical role in the social media strategies of many creators, with 62.7% considering the platform to be an extremely or very important part of their current social media strategy. Consequently, nearly two-thirds of creators (65%) worry that a potential TikTok ban would adversely affect their ability to earn money from their content.

Acknowledging the possible impact of a TikTok ban, many creators have taken proactive measures by shifting their focus to other social media platforms. Among those who consider TikTok to be an extremely or very important part of their current social media strategy, 49% have already started expanding their presence on other platforms, and 21.1% intend to follow suit soon. Should a ban occur, 66.7% of these TikTok-reliant creators are preparing to generate fresh, platform-specific content, while 40.4% plan to repurpose their existing TikTok content for other platforms.

Lastly, all surveyed creators have mixed opinions on whether other platforms can provide comparable personal brand growth opportunities to TikTok. While 37.9% believe other platforms can offer similar opportunities, 14.7% are doubtful that alternative platforms can adequately fill the potential void left by TikTok, indicating they consider it unlikely or impossible for other social media platforms to match TikTok’s unique impact. Regardless of the outcome, the potential TikTok ban is encouraging creators who rely on the platform to reevaluate their content strategies and diversify their online presence across multiple platforms as a precautionary measure.

Conclusion

The creator economy’s projected growth by 2027 presents significant potential for content creators to flourish creatively and financially. As challenges persist in aligning content with monetization and navigating brand collaborations, creators must continually adapt and enhance their skills to maintain a competitive edge.

Focusing on personal branding, embracing new strategies, tools, and technologies, and leveraging music’s influence on content engagement will be crucial for creators to capitalize on emerging trends and maximize success in this dynamic landscape.

Methodology:

The primary survey for the 2024 Future of the Creator Economy Report was conducted on the Pollfish platform in March 2024. A total of 1,500 content creators who are currently monetizing their content were surveyed. The sample represented a diverse range of industries and niches, including YouTubers, podcasters, bloggers, and social media influencers, among others.

Respondents were selected through a screening process to ensure that they met the criteria of being active content creators who are currently earning money from their work. The survey employed a structured questionnaire, and responses were collected anonymously.

*In light of recent discussions surrounding a potential TikTok ban, we recognized the need to gather additional data on creators’ perspectives regarding this issue. As such, we conducted a follow-up survey in May 2024. This secondary survey included a different sample of 1,000 content creators who are currently monetizing their content. The methodology used for the secondary survey mirrored that of the initial survey to maintain consistency and reliability.